As one begins to consider their career plans as accountant seriously, a flood of questions arises concerning the details of an accountancy career:

- What can I do with a Bachelors in Accounting in the public sector?

- Is accounting a good job for the future for me?

- Are accountants happy and satisfied workers?

- What can I do with a Bachelors in Accounting in private industry?

According to the Bureau of Labor Statistics (BLS), there were more than 1,400,000 accountants and auditors employed in the United States. Federal statisticians anticipate the demand for accountants in the future to grow in accordance with the average of all occupations present in the United States.

The demand for accountants in the future will be directly influenced by the health of the United States’ overall economy. Future technological advancement impacting the accounting profession will likely shift accountants to more analytical and advisory roles as professionals.

Accreditation for Accounting Programs

The process of accreditation is performed by independent and sanctioned organizations and agencies who assess the quality of a school and/or a specific degree program based upon pre-set criteria typically approved by industry leaders. Essentially, accreditation offers a form of validation for potential students and industry experts. Given the distance learning options now available, students interested in a career in the accounting field can now choose from several accredited online accounting degree programs from which to graduate.

Program or School accreditation is awarded at a number of levels. Regional and specialized accreditation is discussed below. Accounting school accreditation is issued under the specialized accreditation category.

Regional Level Accreditation

The United States Department of Education (USDE) operates internally-managed regional agencies that are tasked with the responsibility of awarding regional accreditation to schools throughout the United States. USDE accreditation is most preferred. It is considered an exalted accreditation, as it is issued through the federal government.

Specialized Level Accreditation

Specialized accreditation is entirely voluntary. Many undergraduate and graduate accounting degree programs open the school facilities/program curriculum to an industry sanctioned professional oversight accreditation agency or organization. In the accounting industry, degree seekers generally will choose from coursework from AACSB accredited online schools, or ACBSP accredited schools. The differences between ACBSP vs AACSB sanctioned schools and programs are typically debated and noted below.

The ACBSP – The Accreditation Council for Business Schools

The Accreditation Council for Business Schools and Programs (ACBSP) was established in the late 1980s and is one of the primary organizations that offer accounting school accreditation in the field of business and its many sub-specialties. The ACBSP accrediting body awards accreditation honors to ACBSP accredited schools on a global level. In addition, the ACBSP is the only business education accrediting agency to award accreditation for all levels of associates, bachelors, masters, and doctoral programs.

ACBSP accreditation employs the Baldrige Education Criteria (which focuses on student outcomes and teaching excellence) to measure school and program performance. Therefore, those accredited online accounting degree programs with ACBSP accreditation have passed the muster in the areas of program quality, coursework planning, leadership, and the credentials of the faculty.

The AACSB – The Association to Advance Collegiate Schools of Busines

The Association to Advance Collegiate Schools of Business (AACSB) operates internationally from Tampa, FL, Amsterdam, and Singapore. The AACSB was established in 1916 as an independent business oversight organization with a mission to create future business leaders ready for the challenge of a changing business landscape. There are AACSB accredited online schools as well as traditional on-campus accredited schools.

ACBSP vs AACSB: Which is Better?

The debate regarding ACBSP vs AACSB accredited programs and schools has revealed to many business leaders and educational pundits that each accreditation agency complements one another, which ensures the business community prepares accounting professionals practiced in both theory and the application of said theory – with the option to follow the education pathway that best meets their career objectives.

Types of Bachelors of Accounting Degrees

The interesting part of earning an accounting bachelor’s degree or completing the accounting degree requirements for accounting majors is the many and varied ways (and industries) one can apply their specialized training. First, though, one must ask themselves – what are the best fitting programs that offer a bachelor’s in accounting near me? Are there accounting colleges near me with accounting degree options that align with my education and career objectives?

To determine the Bachelors of Accounting program when must determine the priority of the following items –

Are accounting schools online, similar to traditional classroom programs?

Are there accredited accounting schools online or AACSB accredited online undergraduate schools?

- What classes to take for accounting degree?

- Are there accelerated accounting degree online programs?

- What are the cheapest online accounting degree programs available?

- Are there any free online accounting degree programs available?

- What classes to take for accounting degree?

- What are the best colleges for accounting majors?

- Are there any international accounting certifications?

The Types of Accounting Degrees

Typically, those who hold a Bachelor’s of Accounting have the option of studying from accounting schools online or traditional accounting majors coursework to earn the accountancy baccalaureate degree. The cheapest online accounting degree is offered among the many Massive Open Online Courses (MOOCs) as free online accounting degree programs. It is noted that a MOOC course is free to audit, with a marginal cost for the issuance of a completion certificate. (i.e., meeting industry-standard accounting degree requirements).

Generally speaking, the best colleges for accounting majors (within an online program or traditional classroom setting) voluntarily apply and receive accreditation from the Association to Advance Collegiate Schools of Business(AACSB) or the Accreditation Council for Business Schools and Programs (ACBSP). Those programs with accreditation follow curriculum guidelines that set forth what classes to take for accounting degree, the type of accounting degrees, and whether an accelerating accounting degree online is an option.

There are several different types of accounting degrees you may consider:

- Bachelor of Arts in Accounting – lighter on the math, more open in electives

- Bachelor of Science in Accounting – more technical and more rigidly designed

- Bachelor of Business Administration in Accounting – more oriented toward business management and leadership

So, if you are still searching, and asking yourself -what are the best accounting colleges near me?, simply sign on to the internet and begin to research which of the many types of accounting degrees are the right fit for you. Will it be a selection from the many accredited accounting schools online, or a Bachelors of Accounting from a traditional on-campus program?

Certifications/Licenses for Accounting and Finance

In the field of accounting, there are many certifications to obtain, some available as accounting certifications online. The amount of accounting certifications is a direct result of the many specializations in accounting certifications. Accounting certifications range from international accounting certifications to bookkeeping certifications, and tax certifications. The most popular certifications & licenses for accountant professionals is as follows –

The Certified Public Accountant – CPA Certification

The Certified Public Accountant (CPA) certification is the oldest of the many accounting certifications and the most internationally renowned accounting designation in the field of accountancy. To earn a CPA Certification, one must complete their baccalaureate accounting degree and then aim to pass the CPA exams. Most CPA exam takers recognize the need to carve out an appropriate amount of study time by enrolling in a certified public accountant program or a CPA School online designed to support test-takers prior to the CPA exam.

The CPA credential is recognized as the gold standard of accounting certifications without degree. To earn the CPA certificate, candidates must pass all four tests (which are four hours each) included in the CPA exam – BEC – Business Environment & Concepts, FAR – Financial Accounting and Reporting, AUD – Auditing & Attestation, and REG – Regulation, with a minimum score on each part of 75.

The CPA certification generally translates to accounting certification salary increases and better overall compensation packages. CPAs are the only authorized professional to comment on the financials from a publicly-traded company publicly.

The Certified Management Accountant – CMA Certification

A Certified Management Accountant CMA certification is managed by the Institute of Management Accountants. This certification requires candidates to hold an undergraduate degree in accounting, an IMA (Institute of Management Accountants) member, have two years of appropriate work history, agree to align with IMA’s professional, ethical protocols, and to pass both parts of the CMA examination.

A CMA certification prepares credential holders for rewarding executive-level careers as Chief Operating Officers or Chief Financial Officers of large corporations. The CMA certification complements the CPA certification as the requirements do not overlap one another. The Certified Management Accountant CMA certification requires the completion of 2 CMA exams, about 50% of the time required for CPA certification.

These specialization in accounting certifications are ideal for those professionals seeking an executive level management, a financial leadership position. Check out the CMA Handbook for more information.

Government Accounting Certifications: Enrolled Agent (EA)

The Enrolled Agent (EA) certification is among several government accounting certifications available. These accounting certifications online from the government evaluate test-takers knowledge (and application) of the United States Tax Code. An Enrolled Agent certification is strictly tax-related and focused on individuals and corporations.

Tax Certifications:

- The Chartered Financial Analyst (CFA).

- The Certified Internal Auditor (CIA).

- The Certified Information Systems Auditor (CISA).

- The Chartered Alternative Investment Analyst (CAIA).

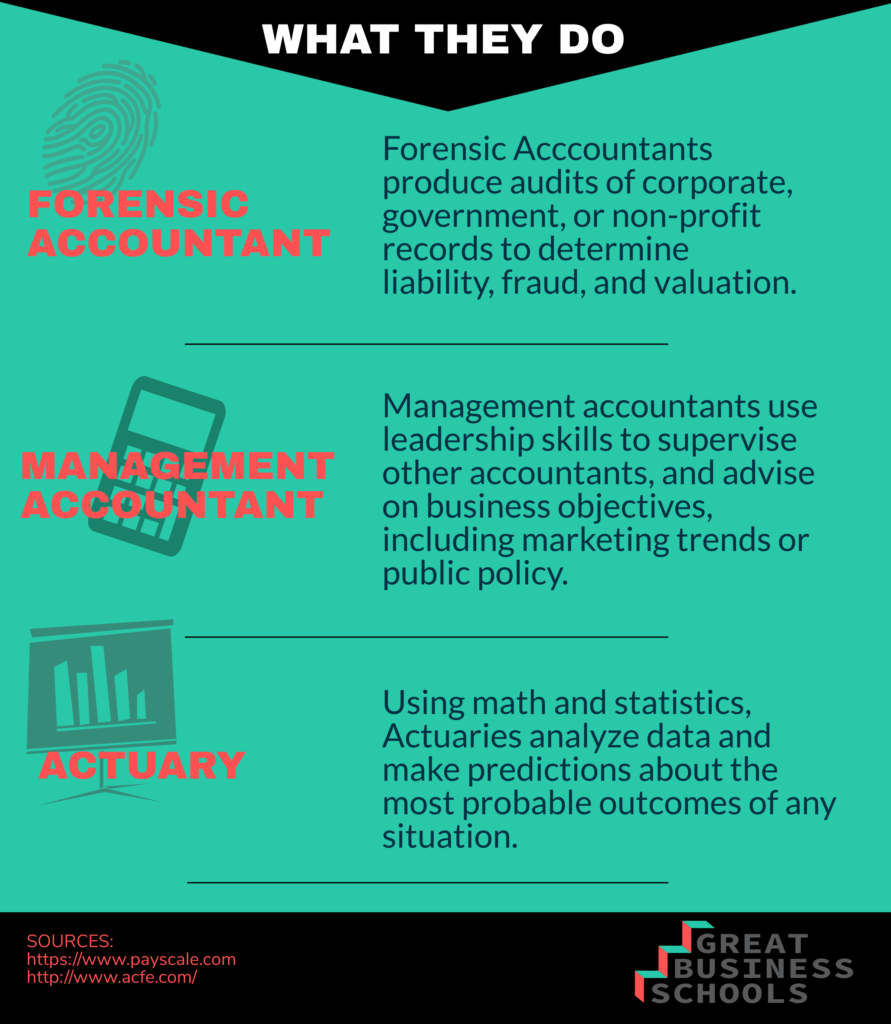

Careers in Accounting

What are some entry-level accounting jobs in today’s marketplace? What are the industries and professions an accountant can enter to apply their skills and financial talents?

Accounting professionals are fortunate as an accounting degree opens an accounting career path that leads to a wide variety of entry-level accounting jobs. As you research career opportunities in the accounting profession, consider these options –

- Careers in Accounting and Finance

- Telecommuting accounting jobs

- Careers in Public Accounting

- A career plan for accountant

- An accounting career path

- A public accounting career path

- Entry-level accounting jobs

- A tax accountant career

- The difference between a public accounting vs corporate account career path

Accounting career information and accounting career path planning are available from many online resources. The federal government’s Bureau of Labor Statistics (BLS) offers a plethora of statistical information about careers in accounting and finance as an auditor, accountant, bookkeepers, and auditing clerks, as well as accounting jobs descriptions. The Bureau of Labor Statistics provides an accounting jobs list of careers in accounting and finance includes specific information for each accounting career path for accounting jobs entry level like –

- Bookkeepers

- Auditing Clerks

- Financial Analysts

- Corporate or Personal Financial Analysts

- IRS Agents

- Tax Examiners

The many career opportunities in the accounting profession open significant employment opportunities – from a tax accountant career, an accounting career path, or other career opportunities in accounting profession to deciding between a professional career public accounting vs corporate accounting.

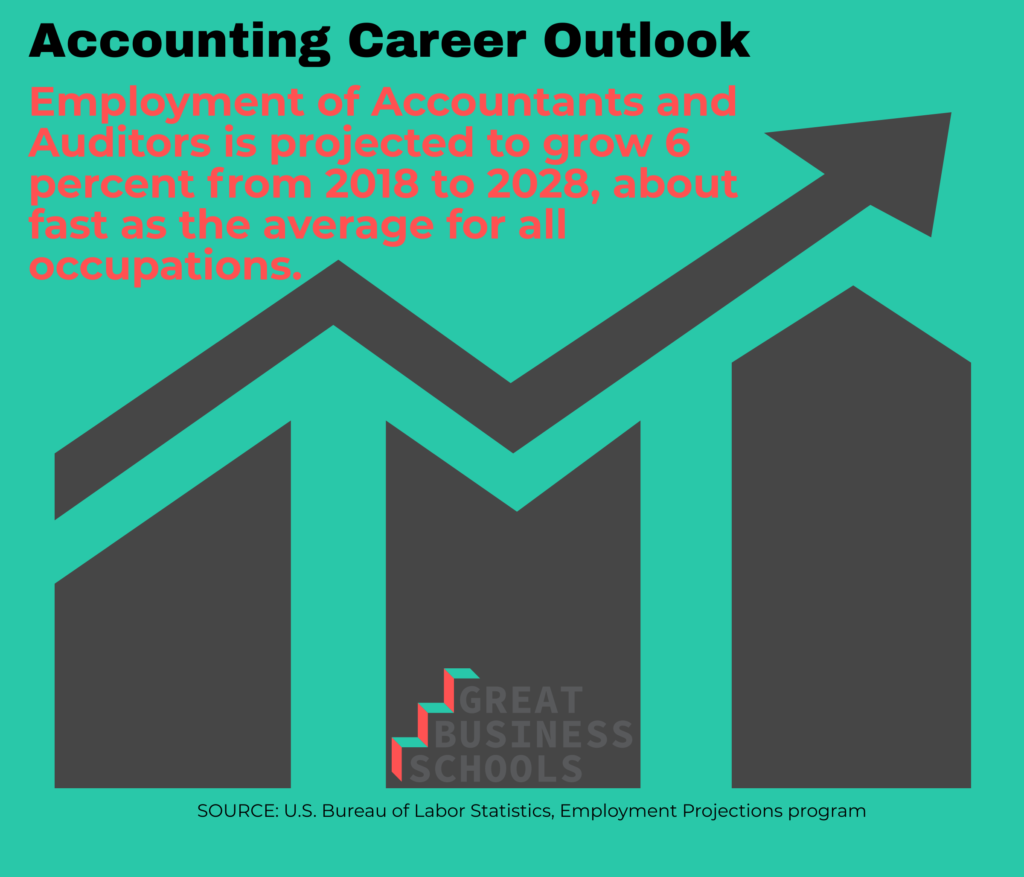

Accounting Job Outlook

As noted previously, the federal government agency known as the Bureau of Labor Statistics categorizes accounting professionals as noted below –

Accountants & Auditors

In 2018, there were more than 1.4 million professional accountants and auditors working in the United States. According to the federal government’s statisticians, the job growth outlook for accountants and auditors to be approximately as fast as the average of all combined occupations in the United States – at 6%. This translates to an anticipated additional 90,000+ accounting positions in the next decade.

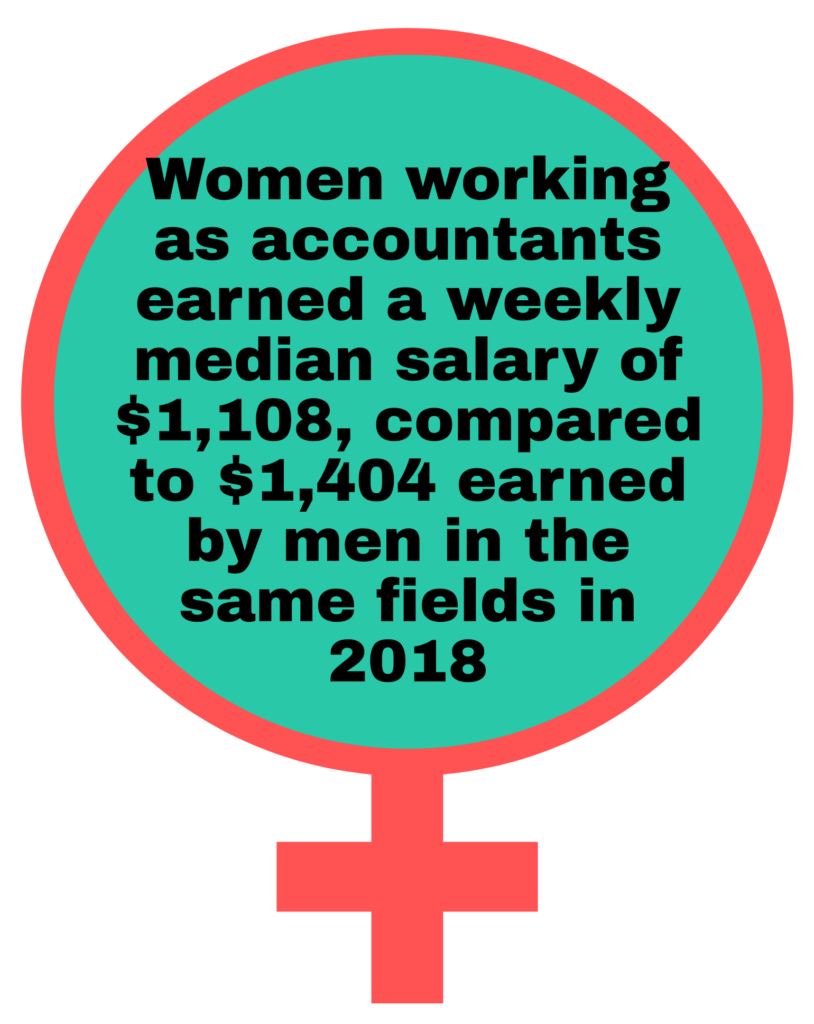

Salary

As previously noted, those who hold a BS, BA, or BBA degree in accounting have many employment options from which to choose. This includes accounting jobs in the private and public sectors. An accountant’s salary will vary based upon the position, the industry, one’s education, and professional experience. One must recognize that the differences based on the following –

- An entry level accounting salary, when compared to the salaries of more experienced accounting professionals.

- The accounting jobs salary with a specialty certification.

- What metropolitan area offers higher accounting careers salary?

- An entry level accounting jobs salary in a specific industry may vary.

- What state pays the highest entry level accounting salary?

The Bureau of Labor Statistics (BLS) is a federally-run agency that collects and analyzes employment data to determine both positive and negative employment trends through real data and to take steps then to support the economy as a whole. The BLS’s website is a valuable tool based upon its detailed analysis of a bachelor degree in accounting salary or the accounting salary of a specialist. The BLS categorizes accounting professionals as – Accountants and Auditors, or Bookkeeping, Accounting, and Auditing Clerks.

According to the Bureau of Labor Statistics (BLS), professional accountants and auditors had the following salary statistics for 2018. –

Auditors and Accounting Careers Salary – $70,500 per year; this translates to $33.89 hourly.

The BS in Accounting salary would be similar to an entry level accounting salary of about $45,000 (the 10 Percentile Wage Estimate), while the upper limits of more than $120,000 (the 90 Percentile Wage Estimate). An Accounting careers salary will also vary based on the position’s parent industry.

Top Paying Accounting Salary Statistics by Industry

- Executive Branch – Federal Government: $100,080

- Financial Investments: $97,000

- Investments – Funds & Pools: $96,770

- Pipeline Transport: $93,590

Bookkeeping, Accounting, and Auditing Clerks

According to the Bureau of Labor Statistics (BLS), professional bookkeeping and auditing/accounting clerks had the following salary statistics for 2018. –

Bookkeeping, Auditing Clerks Accounting Careers Salary – $40,240 per year; this translates to $19.35 hourly.

Annual Accounting Jobs Salary

- Federal Gov’t. Postal Service: $68,580

- Mining for Metal Ore: $56,420

- Oversight Monetary Authorities: $51,690

- Natural Gas: $51,220

- Electric Power: $50,150

Top Paying Statistics by State

- Washington, DC: $54,970

- Alaska: $48,640

- Connecticut: $47,890

- California: $47,750

- Massachusetts: $47,020

Top Paying Statistics by Metropolitan Area

- Oakland, Hayward, San Francisco: $55,010

- California – San Jose, Santa, Clara: $52,640

- California – Napa: $52,330

- California – Santa Rosa: $52,110

- Connecticut – Stamford, Bridgeport, Norwalk: $52,690

The Take-Away

In sum, a BS in Accounting salary varies by the region, state, or industry (among other relevant variables) in which the job is located. Similar to most industries, a bachelor degree in accounting salary will increase from the entry level accounting jobs salary through mid-career and progress even higher through one’s later accounting career years.

Professional Organizations in Accounting and Finance

Each professional industry has one or more oversight agencies tasked with the responsibility of credentialing and advocating as an industry voice in legal, education, and safety matters. These professional organizations offer the following benefits to its accounting memberships holders –

- Networking Options.

- Industry Mentors.

- Resources for Educating its Professionals.

- Employment Boards

The accounting industry has several accounting organizations dedicating to overseeing the industry and advocating for the improvement of the industry. Two influential accounting organizations include the Professional Accounting Society of America (PASA) and the American Accounting Association (AAA).

As you consider your accounting career options consider the American Accounting Association definition of accounting when developing your career plans –

The process by which an accounting professional identifies gathers and evaluates financial/economic data to allow for educated choices and decisions of financial managers.

The American Accounting Association (AAA)

The oldest of all accounting organizations is the American Accounting Association, which was established more than 100 years ago, in 1916.

The American Accounting Association also holds the distinction of having the largest number of accounting memberships in the academic community. The AAA’s reputation is impeccable and often at the forefront of cutting-edge research and professional publications. American Accounting Association’s mission is to remain the thought leader organization that includes its members in helping to form a better future for the accounting field.

The American Accounting Association recognizes that AAA members align with the accounting membership’s ethics – Objectivity, Exceptional Communication Skills, Respect for Consumers, Consultants and Colleagues, plus a commitment to Integrity in all professional dealings. The American Accounting Association offers services and benefits that include –

- Learning Enhancements implemented to further the future education possibilities of the accounting profession.

- Hosting the Annual Accounting Hall of Fame Inductee Festivities, which began in 1950.

- Opening up avenues that lead to the advancement of accounting knowledge.

- Service Activities

The Professional Accounting Society of America (PASA)

The Professional Accounting Society of America (PASA) was established by several accounting professionals working for public accounting companies from different sections of the nation. Its initial purpose was to develop an informal communication network that connects industry professionals and their friends.

From this simple idea grew what is now considered a top contender for newbie accountants and those with a handful of years of experience – at a mid-level accountant level; however, they actively recruit members from all levels of the accounting hierarchy. When the PASA network hit the internet only a few years after the turn of the century, access was granted to as many accounting professionals interested in PASA.

PASA is a free service that offers the following member benefits –

- Accounting Job Boards

- Networking opportunities to meet colleagues and peer

- Certified Public Accountant (CPA) Exam support and insight

- Newsletters that Promote the Industry and its Professionals

- Discounts available to members only

- A Resume Builder Program

- Access to PASA member events

- An Active Blog that distributes relevant, topical accounting headlines and news

The Professional Accounting Society of America (PASA) began with a mission to be the collective voice of its member accounting professionals. The professional organization operates a platform that allows for the free and open exchange of accounting industry insights, innovative ideas, or member opinions.

There are additional accounting professional organizations that include, in part –

- The Accountant-Lawyer Alliance (ALA).

- The National Association of Certified Public Bookkeepers (NACPB).

- The National Association of Enrolled Agents (NAEA).

- The National Society of Accountants (NSA).

- The Association of Accountants & Financial Professionals in Business (IMA).

- The American Institute of Certified Public Accounts (AICPA).

- The Professional Association of Small Business Accountants (PASBA).

Carrie Morris

Author

Warren Dahl

Editor-in-Chief