When it comes to careers in mathematics, you may have questions or concerns about your options. What is an actuary? Does the actuary job description fit your long-term goals? What does an actuary do in their job? By clarifying the details of the career and job responsibilities, you can determine if the job is the right option for your plans.

The definition of actuary professionals is a person who evaluates risk to a business based on statistical and mathematical data. What an actuary does in their day-to-day job may vary based on the needs and risks to the business. The description of an actuary is a professional who works with statistics, math, and financial theories to assist a business in making realistic goals for the growth of the company.

What do actuaries do? It depends on the industry, the risks to the company, and the statistical data. In many situations, an actuary manages risks, develops a plan of action based on the risk factors to the business, and clarifies information. While the traditional role of an actuary focuses on the insurance industry, the demand in other businesses is growing. Is a masters in actuarial science worth it for your career? It depends on your goals and interests. If you are interested in a growing industry that uses math and financial theories to assist a company with long-term growth, then you may find that a degree is a good option to obtain new opportunities.

Accreditation for Actuary Programs

When you are looking into the best actuarial science graduate programs, you want to look into the accreditation of the program. The best graduate schools for actuarial science will have accreditation from a recognized third party or organization for the educational program.

Accreditation in actuarial science at the master’s level may come from nationally recognized organizations or it may stem from regional organizations. You want to evaluate the organization, its standards for student education, and the details of the accreditation process to ensure that the school is ideal for your goals.

You may look into accreditation from the Society of Actuaries or the Casualty Actuary Society to ensure that a school meets specific standards of education. You may also look for accreditation from other organizations if you are unsure about the best options for your education.

Avoid any school or program that does not have accreditation for the program. If the program is not accredited, it may not offer the same level of education or high standards for student excellence when compared to accredited options. In some cases, an employer may hesitate to hire students who do not complete a degree at a program that does not have accreditation from a respected third-party organization.

Types of Actuarial Science Master’s Degrees

Evaluating the options for a career in actuarial science may mean that you focus on a specific industry or concentration within your major. You may also look into different opportunities in regards to the programs available through different colleges and universities. At the master’s level, you may discover that you have a variety of degree options that help you specialize or work around your current obligations.

A masters in actuarial sciences may focus on a variety of topics and areas of interest. The traditional masters in actuarial science program emphasizes the role of a professional in insurance. You may learn about topics related directly to insurance or topics associated with the industry with an emphasis on statistical data analysis. A master in actuarial science may also emphasize the use of technology in the industry. Since the role is growing in different industries and fields, you may discover that colleges and universities are taking measures to keep up with the potential roles and offering concentrations that work within new industries and areas of interest.

The types of master’s in actuarial science programs are not limited to the concentrations available through a college or university. You may also look into online masters in actuarial science programs. A master’s in actuarial science online offers similar educational benefits to an in-person class; however, it also allows you to work around a flexible schedule.

When it comes to a master’s in actuarial science online program, the primary advantage of online degree programs is the opportunity to work around your current obligations. You can keep up with your job responsibilities or your personal obligations to others while you complete your degree. An actuarial science master’s online program also allows you to work at your own pace. You can take accelerated courses to finish your degree at a fast pace. You may also be able to take classes part-time if you need extra time to work on the degree. The flexibility in relation to your time gives you an advantage when it comes to obtaining your degree.

When it comes to the types of actuarial science master’s degree online programs, you will notice that you have similar concentrations and opportunities when compared to in-person courses. You will want to evaluate each program and college carefully to ensure that the program is accredited and fits with your long-term goals.

Although graduate programs for actuarial science are a critical part of obtaining your career goals, you should be aware that your undergraduate degree may assist with helping you gain specialized skills within your industry. A graduate degree in actuarial science may emphasize mathematics, statistics, business, finance, and related fields or industries. If you have an undergraduate degree in a related field, then it may help you accomplish your goals by giving you the specialized abilities that fit with your plans.

Obtaining Certification or Licenses for Actuary Careers

Certification and licensing for actuary careers depends on your employer’s standards and requirements. As a general rule, students will complete examinations as part of their education to finish a master’s degree. The exams show that students understand the concepts and topics discussed in course materials.

Students may be required to obtain certifications based on the needs of employers. For example, actuaries who work in the finance industry may need to obtain specific finance-related certifications and licenses as part of their jobs.

It is common for many employers to require new professionals to obtain a certification from the Society of Actuaries or the Casualty Actuarial Society. The certification may take between two and six years, depending on the type of certification and the student’s focus on completing materials for certification.

Licensing standards for actuaries may vary based on the position and role of the professional. In general, it is not necessary to obtain a license to start working as an actuary. In some positions or roles, an employer may require professionals to obtain a license in specific areas; however, the standards may vary based on the needs and goals of the employer.

Students who are looking into graduate certificate programs may discover that most programs focus on emphasizing specialized actuarial skills. They are designed to work with your degree and help you gain specific skills that may be useful when looking into career opportunities.

Careers in Actuarial Science

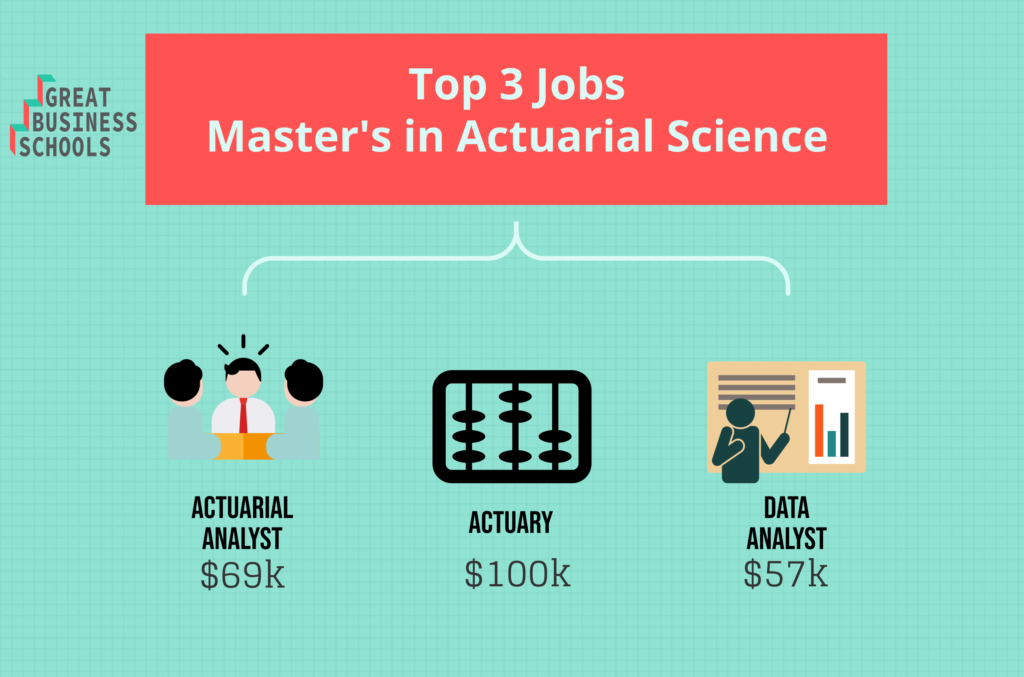

After obtaining a degree in actuarial science, you may have concerns about the jobs for actuaries. Actuary science jobs are often associated with the insurance industry. You will find opportunities in traditional insurance companies and roles when you are looking into jobs in actuarial science; however, you may also find non-traditional roles that work with your long-term goals.

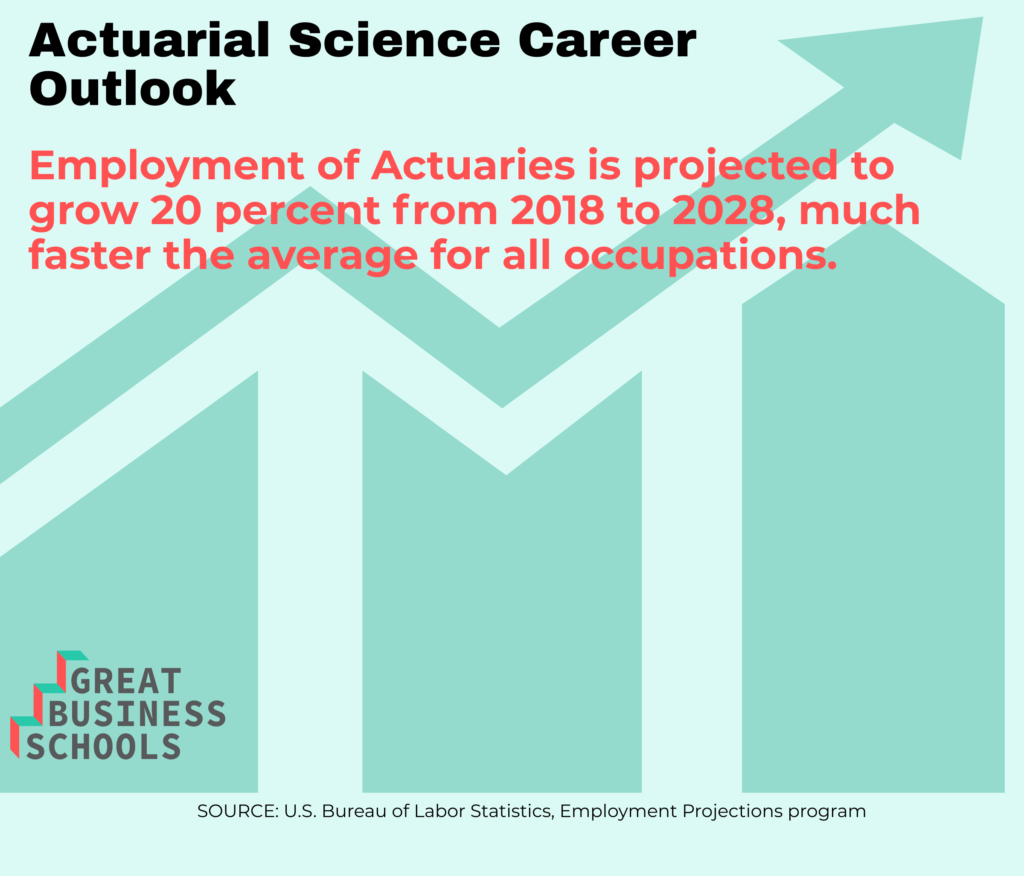

Actuarial science jobs allow you to work in a variety of industries and positions. The actuary jobs outlook is positive with a faster-than-average growth according to the Bureau of Labor Statistics. Since the job outlook for actuaries is growing, you will want to consider alternative roles when looking into a job for masters in actuarial science professionals.

The process of how to become an actuary gives you an idea of your opportunities for your career. As a general rule, actuarial science programs will have students study business, finance, mathematics, and statistics as a core part of student education. How long does it take to become an actuary? That depends on your goals and the level of education you pursue. If you decide to pursue a master’s degree, then you can expect it to take between one and two years after you complete an undergraduate degree.

How many years does it take to become an actuary in a traditional industry? It may vary based on your employer’s standards. When you are looking into how do I become an actuary, you will notice that you have different paths and options to reach your goals. The key is focusing on the right area of education based on the industry you plan to work in after you finish your education.

Careers as an actuary may allow you to work in unexpected fields or industries. For example, you may find opportunities in environmental finance that allow you to apply your skills and training to environmental fields or industries. The role focuses on the financial aspects and risks associated with environmental issues and the goals of an organization as it relates to the environment. You may find that you can work within an organization to distribute funds for projects, identify financial risks associated with specific goals, or find ways to raise extra funds for a project.

An actuaries career may also focus on pricing within a company. When it comes to identifying a reasonable price for a new product or service, an actuary plays a critical role in evaluating the statistical data associated with the product or service. Pricing is a critical part of profiting as a business. A company needs to set a price that allows the business to make a reasonable profit, but also encourages customers to buy the item or seek out the service. You must also keep prices competitive when working within a saturated market. The role of an actuary when working in pricing is to evaluate the data and clarify the mathematical details to set a reasonable price that allows the business to grow and profit over time.

Consulting is another option for professionals with an actuarial science master’s degree. A consultant is self-employed and may work for a variety of companies. In general, consultants offer advice about financial risks to businesses in relation to employee insurance and benefits. It gives the company an idea of the potential downsides offering certain benefits or insurance policies, as well as options that have a lower risk based on the type of employees the business needs.

Individuals who want to work within government agencies may find opportunities within the healthcare or retirement financing industries. The roles may focus on the risks and benefits of social health programs or social retirement programs based on the population and demographic details. By working within the government, actuaries focus on large-scale goals that may apply to a country-wide policy or change to an industry.

Individuals who are considering the possibility of taking on an entrepreneurial role may use their education to reach their goals. The degree emphasizes math, business, and risk analysis. It provides a strong foundation that allows professionals to determine an effective course of action based on their goals for a company. The unique skills associated with an actuary program ensure that students are able to take on challenging positions within a business. In some cases, it also provides a strong foundation in business and finance that allows students to start a new company.

Is actuarial science a good career? It depends on your goals and long-term plans. You can take on careers within a traditional industry like insurance or finance. You can also look into less traditional positions and focus on jobs that are unique and unexpected. The opportunities that are available to professionals with a background in actuarial science range from mathematics, insurance, and finance to healthcare and government positions. You can find a career that fits your interests and goals after obtaining a master’s degree in actuarial science.

Salary Potential for Actuaries

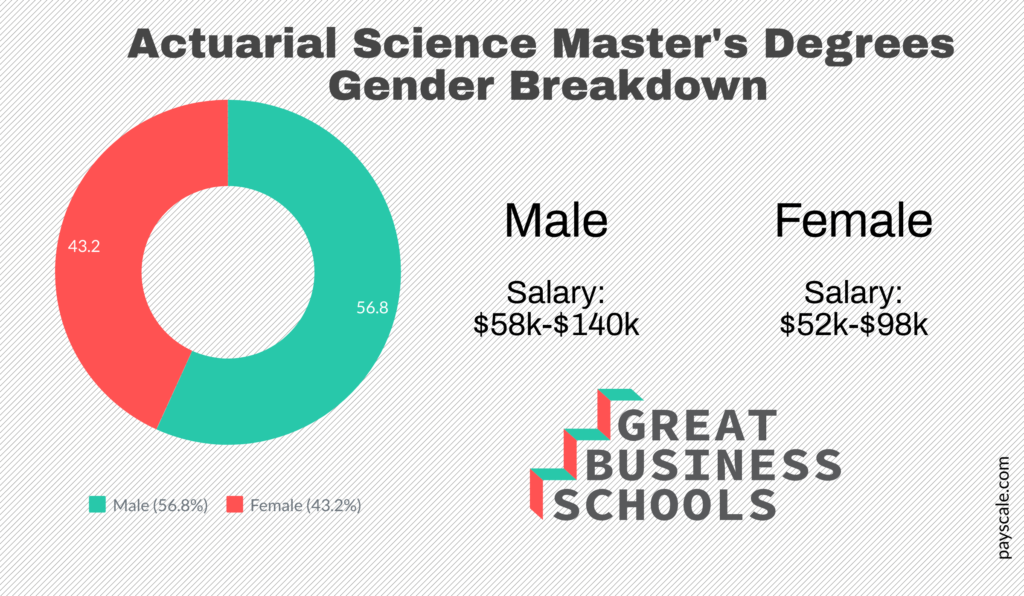

A key component of evaluating any career opportunity is clarifying the salary potential for the position. The salary for an actuary may vary widely based on education level, your position within a company, and the type of industry.

The average salary of actuaries is around $102,800 per year. Although the average salary for an actuary is relatively high, you should keep in mind that starting salaries may be lower than the average. As you gain experience and you develop unique skills that relate directly to your industry, you may earn more when compared to the average.

The Bureau of Labor Statistics points out that the top 10 percent of actuaries make around $186,000 per year and the lowest ten percent of actuaries make around $61,000 per year. Since you can start working as an actuary with an undergraduate degree, you can expect a slightly higher starting salary if you obtain a masters degree.

The masters in actuarial science salary may vary widely based on the industry. For example, the average salary if you decide to work in professional or technical services is around $108,000 per year. In comparison, the average salary if you work in a management position is around $97,000 per year. You can expect to earn more when working in technology companies, professional services, or scientific companies. If you are working in insurance or a related field, you can expect a mid-ranged income level. Government positions will pay close to the average for the position.

In careers that are unusual, the exact pay will vary significantly. An entrepreneur may make more or less than the average depending on the success of his or her business. A professional working for a non-profit organization with a focus on environmental finances may make less when compared to professionals working in a private corporation. Keep in mind that income potential is variable based on your role and industry, so you will want to look into industry-specific salary potential before clarifying the average within a specific type of company.

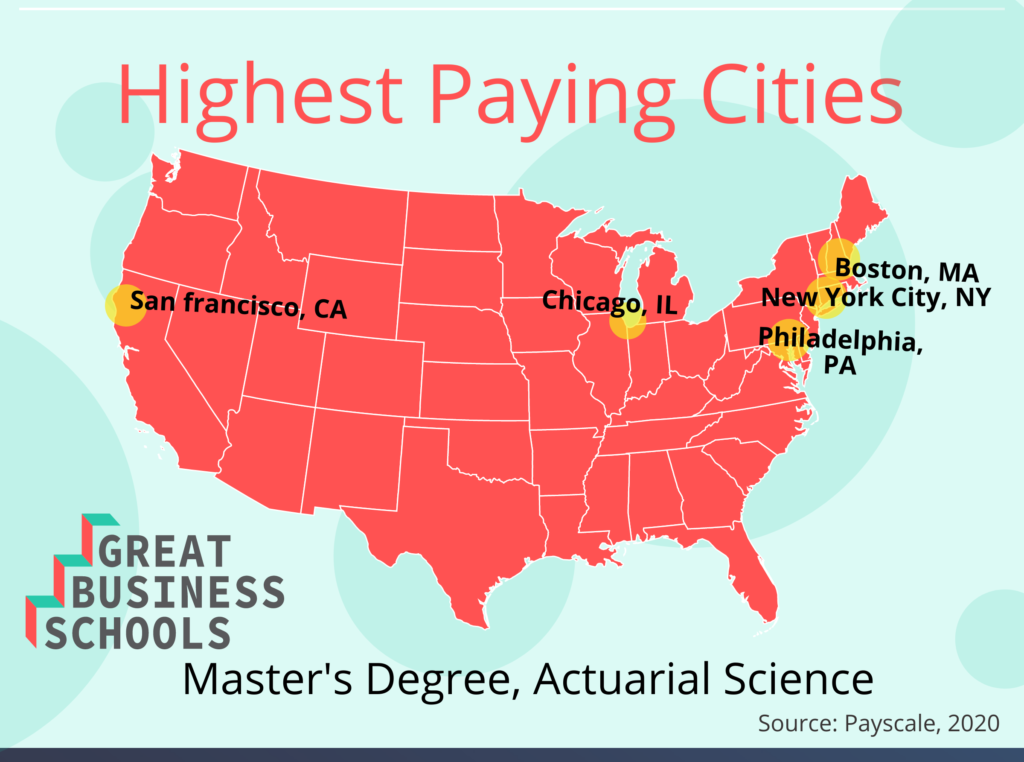

You should be aware that the differences in salary potential may also relate directly to your location. The average salary for an actuary working in New York is around $150,000 per year. In other states, you can expect a lower average salary due to differences in the cost of living and the state standards for income. If you are looking for a higher salary for your work, then you will find that metropolitan areas may pay more when compared to rural environments. The exact variation in pay depends on the state and the locality, so you will want to look into information about the specific location to clarify income potential.

The job outlook for actuaries is positive. The Bureau of Labor Statistics reports that it has an expected growth of roughly 20 percent within ten years, so the number of positions available is growing. Part of the growth of actuary positions stems from the growth of the role in non-traditional companies and positions. It also relates to the number of professionals who plan to retire as well as the changes to demographic details.

Since the role offers a reasonable income and a high starting salary, it is a good opportunity for students who are looking for a well-paying job related to mathematics or statistics. It also allows students to study more varied topics focusing on business and finance, which opens doors for different career opportunities.

The income potential for the role differs based on many factors. You will want to clarify the potential factors that contribute to your income level when evaluating a job. Keep in mind that companies may also offer benefits like bonuses that may add to your salary. Look into the details of any position and role to clarify if it is a good fit for your goals.

Professional Organizations in Actuarial Science

When you are looking for ways to network and to reach out to others within your industry as an actuary, you will want to consider joining a professional organization. In the case of actuaries, there are three primary organizations in the United States that offer membership to professionals who complete their education in actuarial sciences and join as a member. Keep in mind that standards to join an organization may vary widely based on the organization.

The primary organizations for actuary professionals are

You can also find professional organizations in other countries if you are considering a position abroad.

A key advantage of the organization is the opportunity to network with like-minded professionals. It may help you gain opportunities to grow in your career and to find new positions in a company. In some cases, you will have access to job boards or job opportunities directly through the organization. The job opportunities available through the organization may vary based on availability at the time you join and your level of experience, so you will want to pay attention to any standards set for potential candidates.

You will also find that you have options to keep up with continuing education requirements for your job. Since many actuaries follow through with continuing education courses throughout their careers, it is important to find effective programs to keep up with changes to technology, actuarial studies, or related topics. Professional organizations often offer continuing education courses to members of the organization. That allows professionals to stay up-to-date while also meeting any standards set by an employer in relation to continuing education.

When you are looking into the standards to join a professional actuary organization, you will want to evaluate the requirements for membership. In some cases, you may need to take examinations to show that you are qualified for a position or you may need certification from the organization to join as a member. The certification may also apply to your career or job, so look into the details of the organization and its standards when you are planning to join as a new member. You will also need to maintain good standing within the organization to maintain your membership over time.

Carrie Morris

Author

Warren Dahl

Editor-in-Chief

Ready to find the perfect business program?